The Order In Which Income and Investments Are Used for Expenses

When I have an expense, which sources of income are used to cover it first? What about investment assets?

The order is as follows:

Additional Cash Inflows

Social Security

Pensions

Required Minimum Distributions (RMDs)

Deferred Compensation

Taxable/Tax-Advantaged Growth

Taxable/Tax-Advantaged Principal

Non-Qualified Tax-Deferred Growth

Non-Qualified Tax-Deferred Principal

Qualified Tax-Deferred Growth

Qualified Tax-Deferred Principal

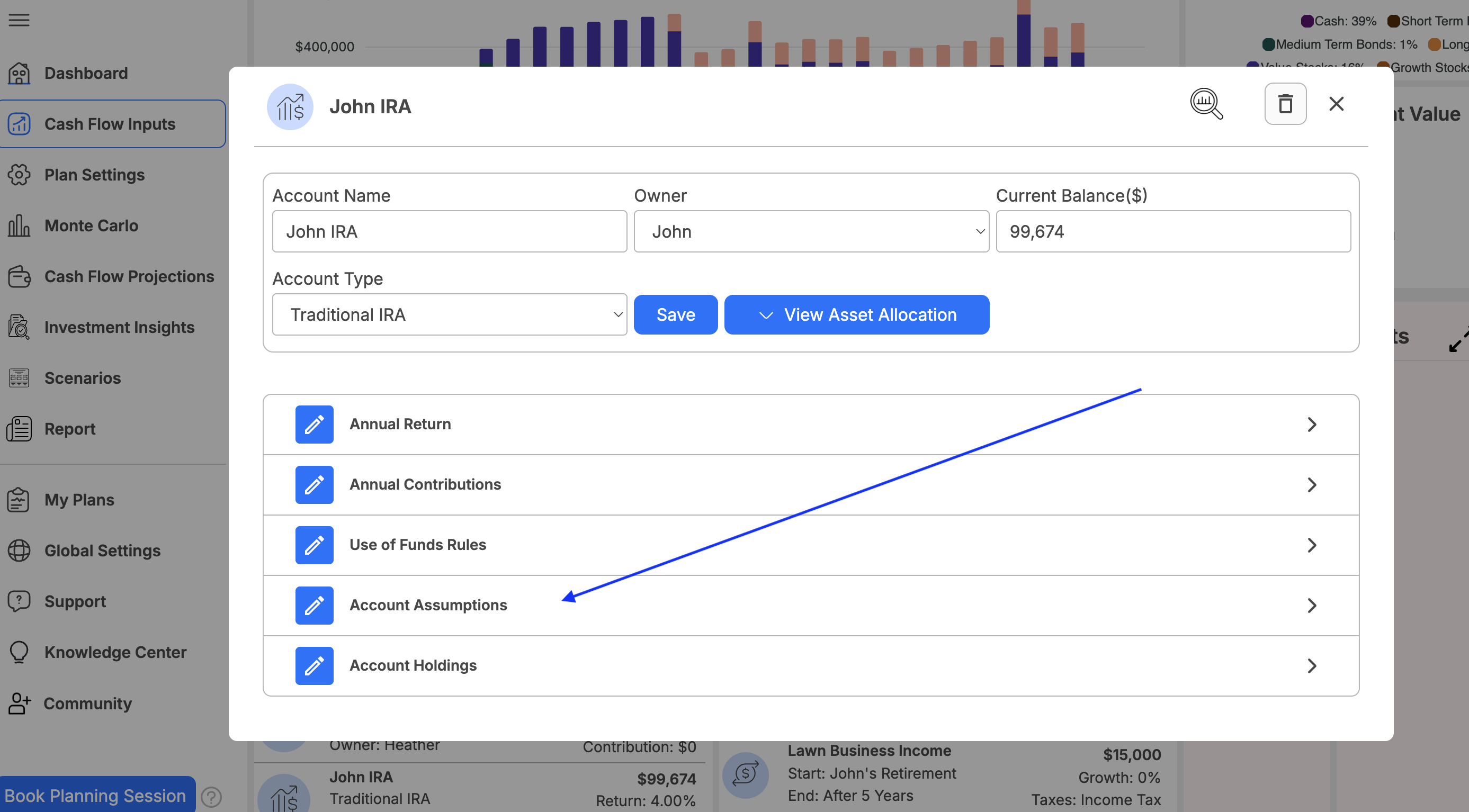

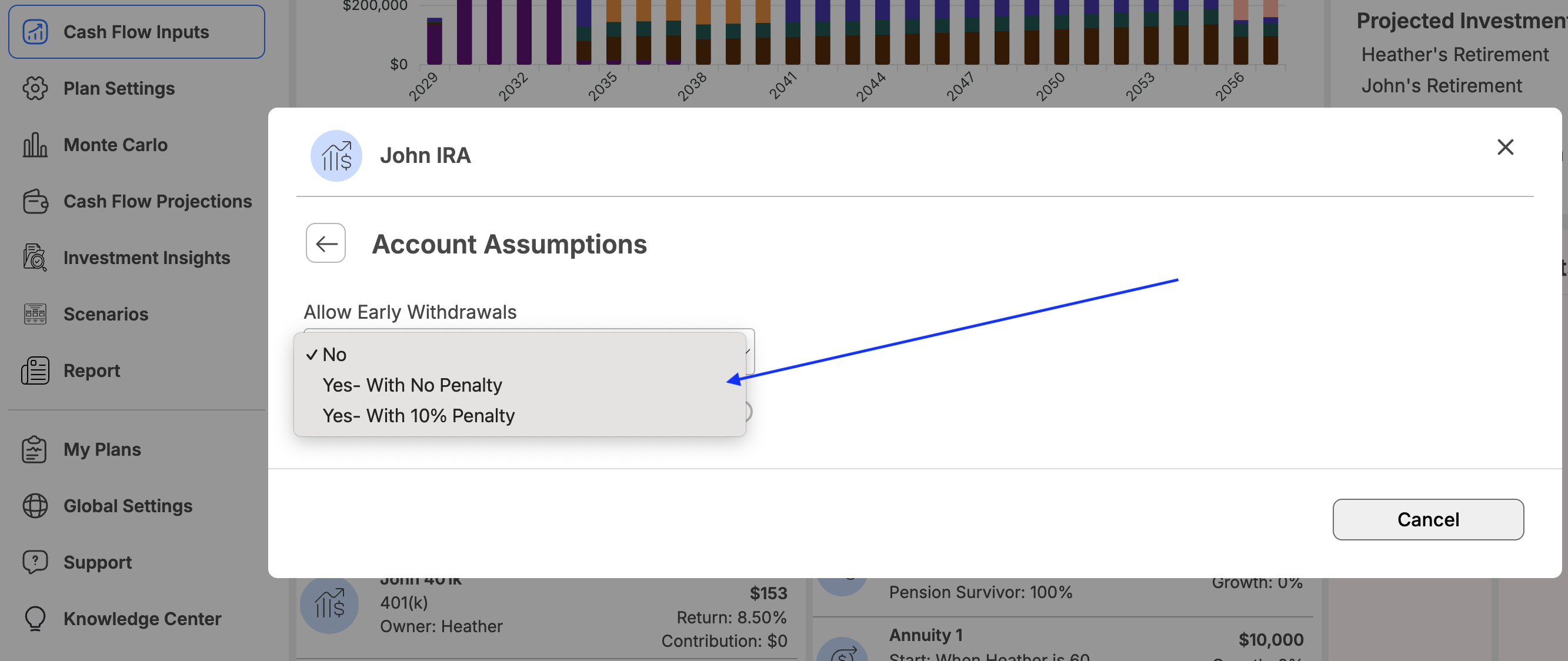

This is usually the most tax-efficient way to withdraw money. You can also lock out investments from being used, and you can change the order of withdrawal in each section by dragging and dropping investment rows The default for Qualified-Tax Deferred Retirement accounts is to not allow such accounts to be used until age 59.5, when there are no penalties for withdrawal. This, too, can be changed as seen in the screenshot below.