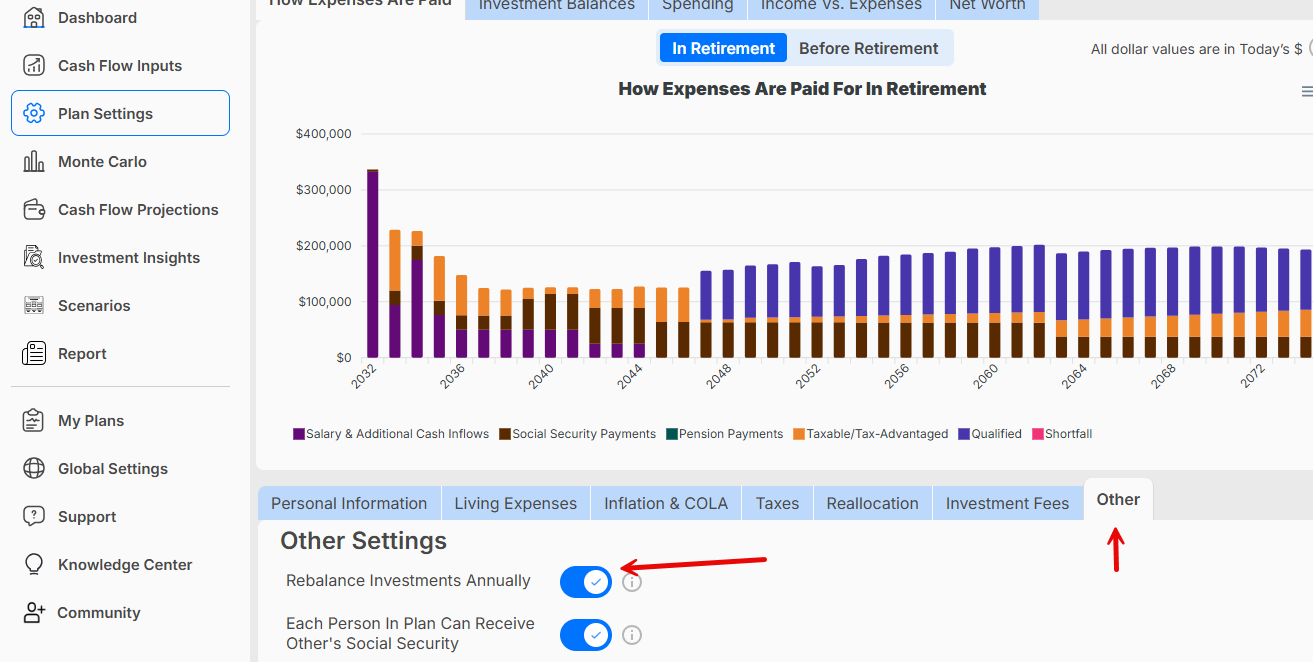

Rebalance Setting

How does the setting Rebalance Investments Annually work?

If the setting 'Rebalance Investments Annually' is set to Yes, the balances of accounts in each investment section will be rebalanced back to their share that existed at the beginning of the first year. For example, let's say you have two investment accounts in the Qualified Tax-Deferred section. The first has a starting balance of $500,000 and the second has a starting balance of $400,000. The first account has a beginning percentage of 56% and the second account is 44%. Regardless of the growth of these accounts or withdrawals from them, they will be rebalanced at the end of the year such that the first account is once again 56% of the total and the second is 44% of the total.

The idea behind this is that most people do rebalance to maintain their current allocation each year and this is a way to handle this for financial projections in every year.

Note that in the Taxable & Tax-Advantaged section, only accounts that have an Account Type of 'Taxable' or 'Bank Account' are rebalanced. Accounts such as 529 plans, Roth IRAs, and Tax-Free Interest are not rebalanced. In the Qualified Tax-Deferred section all account types are rebalanced except Inherited IRAs. In the Non-Qualified Tax-Deferred section, all account types are rebalanced.