Part Time Job and Payroll Taxes in Retirement

I will have a part-time job in retirement. I added this in the Additional Cash Inflows section. But I don't think payroll taxes are being taken out. How do I account for this?

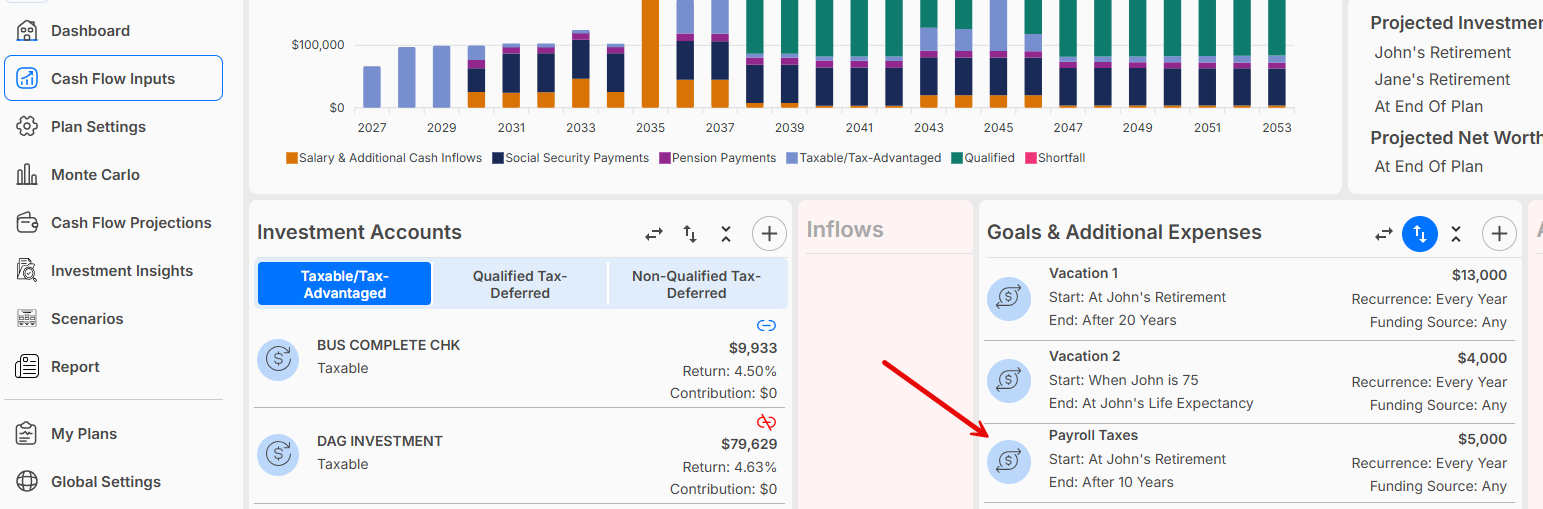

Payroll taxes are not deducted from entries in Additional Cash Inflows. You will want to add payroll taxes for the part-time job as an expense in the Goals & Additional Expenses section. This expense should begin when the part-time job does, and should end when the part-time job ends.