How to Model CDs That Mature And Are Reinvested in a New CD

If I have a 24-month CD earning 4.5%, but assume that it will be reinvested at a lower rate (say 2.5%) when the original CD matures, how do I model this?

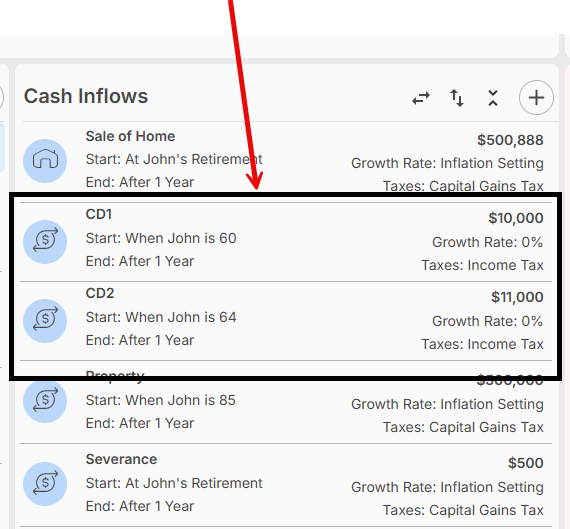

The way to handle this is to model each CD as an Additional Cash Inflow instead of an investment. In the screenshot below we modeled a CD with a 4.5% yield that matures in two years (at age 60 for this person). The amount that is paid out is then reinvested into a 2.5% CD for four years. Note that the way this is modeled assumes no interest payments on the CD. The interest is compounded and added to the final payout. You can use this site to help you calculate the CD maturity amounts.