Roth Conversion Optimization

I want to find the optimal Roth conversion strategy.

Roth Conversion Optimization

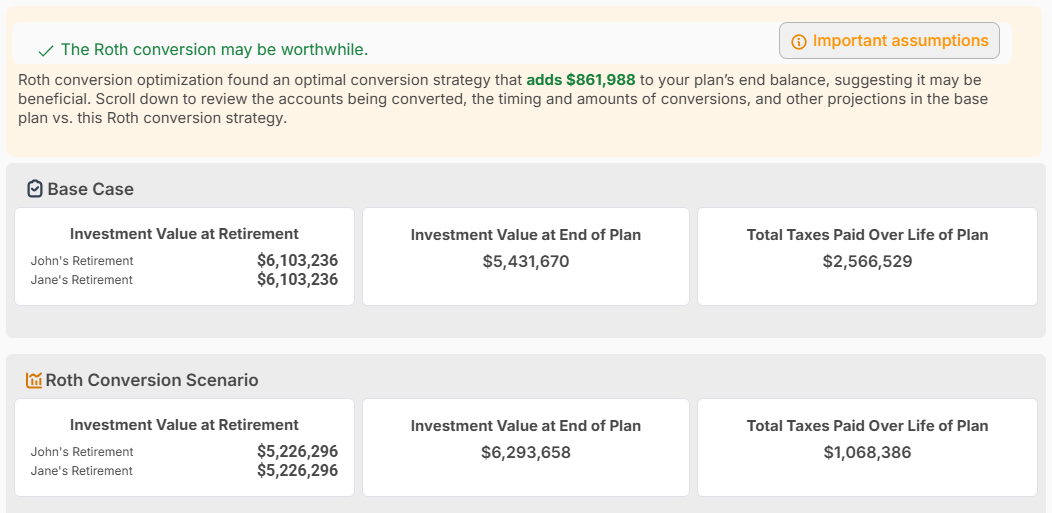

Roth Conversion Optimization helps you decide how much to convert from pre-tax retirement accounts (like a Traditional IRA or 401(k)) into a Roth account, and when to do it. Converting can be powerful because it turns pre-tax savings into tax-free growth, but it also creates taxable income in the year(s) you convert—so the “best” plan is usually about balancing taxes today against benefits later.

What the optimizer does

The optimizer tests many conversion strategies across future years to identify an approach that best matches your objective, such as:

- Maximize long-term after-tax wealth (keep more money in your pocket over time)

- Minimize lifetime taxes (reduce total taxes paid across your lifetime)

- Maximize the Investment Value for Beneficiaries (help heirs receive more after-tax value)

To evaluate strategies, it automatically models key tax factors that commonly impact conversions, including:

- Federal and state income tax brackets

- How conversions can affect Social Security taxation

- Capital gains rates and interactions with other income

- Potential IRMAA surcharges (higher Medicare premiums triggered by income)

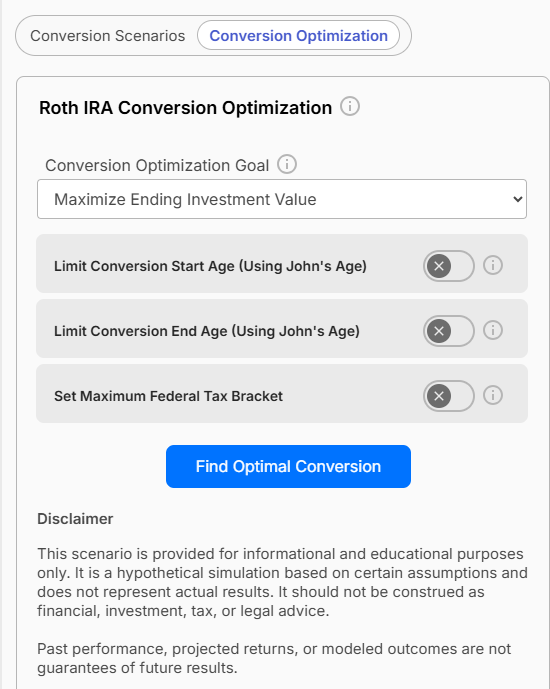

Customize your constraints

You can guide the optimizer with rules that reflect your preferences and plan design, for example:

- Set the start and end ages for conversions

- Choose a target such as staying under a specific tax bracket

- Limit conversions in years where income spikes (e.g., large bonuses, selling a business, required withdrawals)

How it finds the best strategy

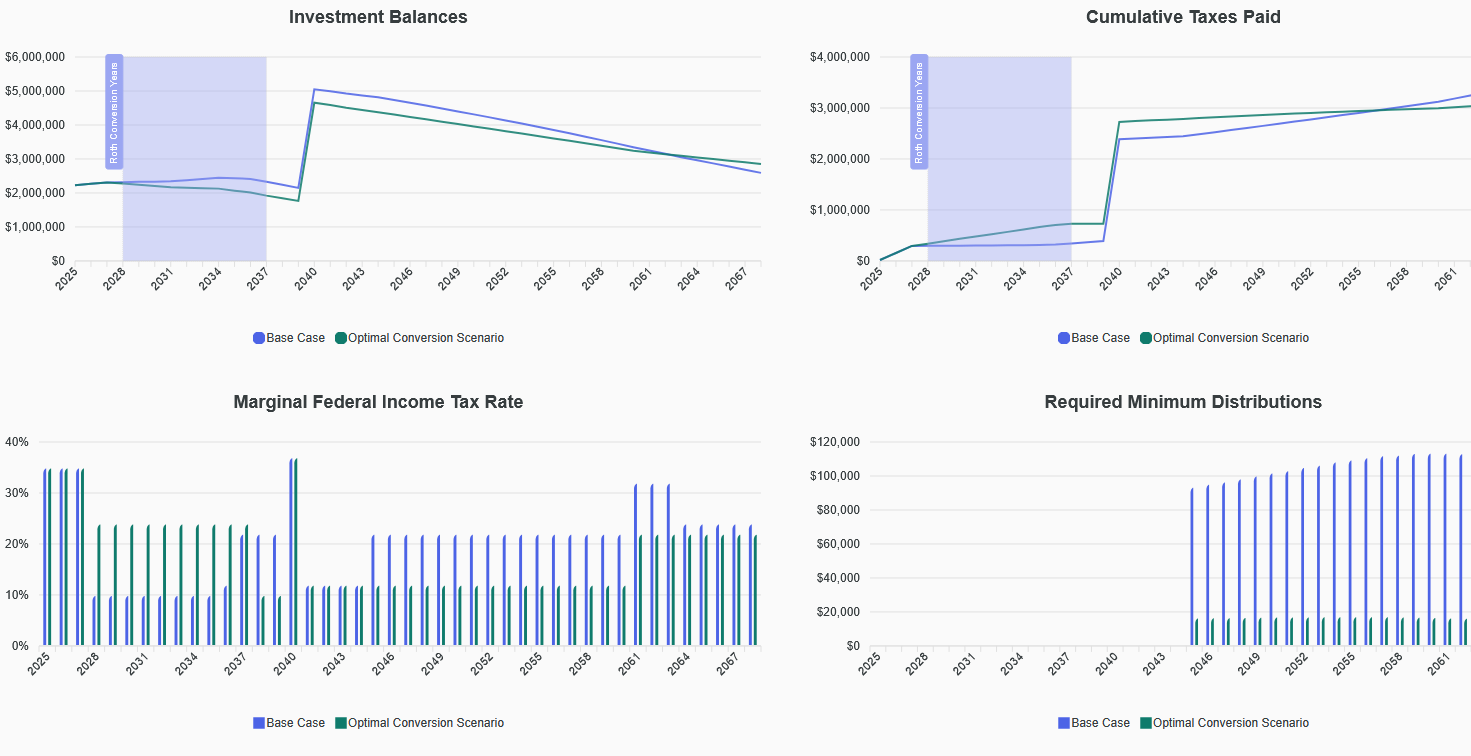

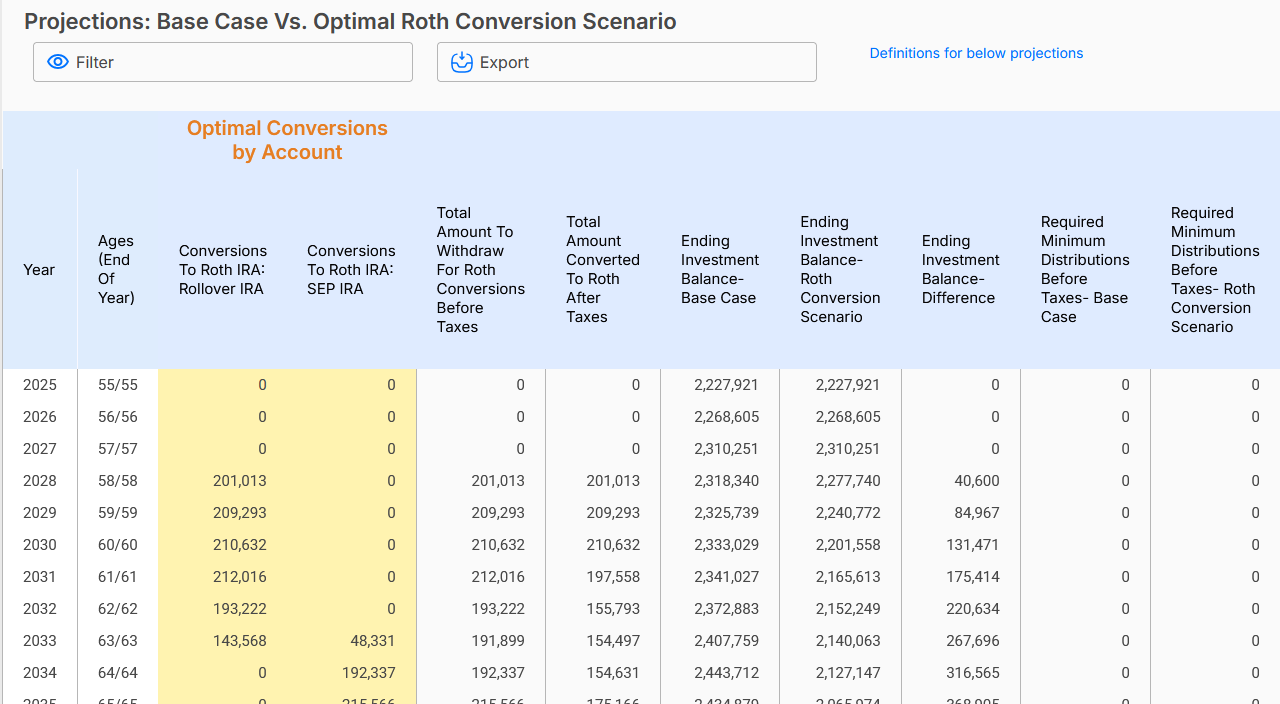

Once your constraints and goal are selected, the tool runs simulations across future years and compares outcomes side-by-side. By testing thousands of possible conversion paths, it helps you:

- Avoid converting “too much” in high-tax years

- Take advantage of lower-tax years when they occur

- See the tradeoffs between paying more tax now vs. later benefits

The result is a clear, data-driven recommendation that aligns with your inputs and priorities.

Option: Maximize the Investment Value for Beneficiaries

If leaving assets to heirs is a priority, you can choose Maximize the Investment Value for Beneficiaries as your goal. This setting shifts the optimizer toward strategies that increase the after-tax value your beneficiaries receive, not just your own lifetime tax bill. You can read more details on the Maximize the Investment Value for Beneficiaries option here.

In practice, that often means the optimizer may:

- Favor conversions that create more tax-free Roth value for heirs, even if it slightly increases taxes during your lifetime

- Reduce the chance that beneficiaries inherit a large pre-tax balance that could trigger higher taxes when they withdraw it

- Balance conversion timing so that conversions happen in years where the tax impact is most efficient, while still building meaningful Roth assets for transfer

Bottom line: This option is best when your plan is focused on legacy outcomes—helping beneficiaries potentially receive more value after taxes—while still staying mindful of brackets, Medicare-related thresholds, and other tax interactions.