Roth Conversion Optimization for Beneficiaries

I want to optimize Roth conversions for my children to give them the most after-tax money possible.

How “Maximize the Investment Value for Beneficiaries” works

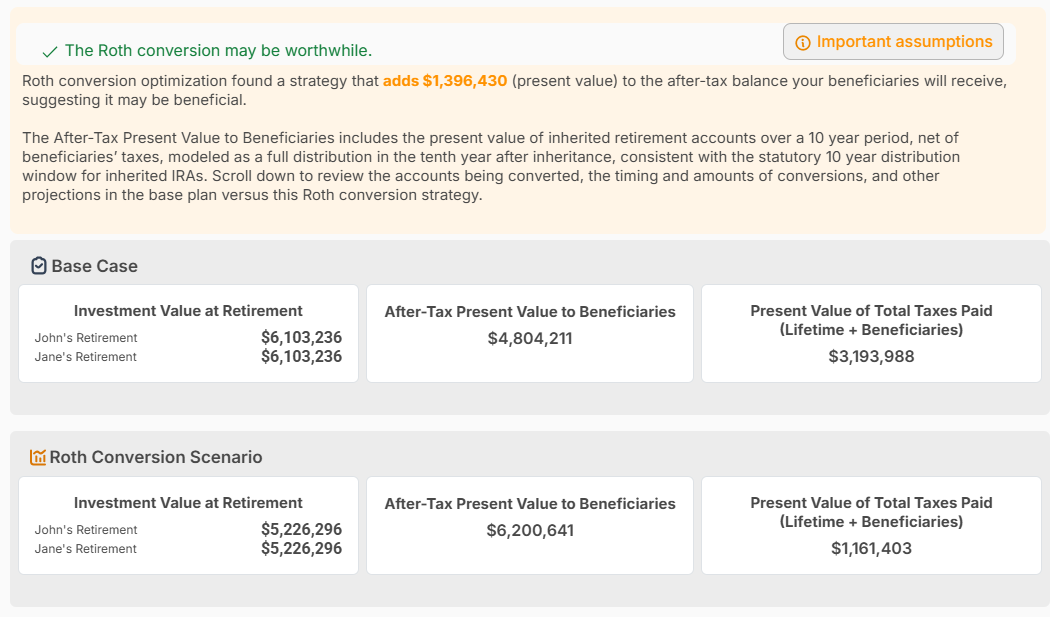

When you pick Maximize the Investment Value for Beneficiaries, the optimizer stops focusing primarily on your lifetime outcomes and instead prioritizes how much after-tax value your beneficiaries are expected to receive from what you leave behind.

That changes the math in two big ways:

- It evaluates outcomes from the beneficiary’s perspective (after their taxes).

- It converts future beneficiary dollars into present value, so it can fairly compare “value delivered” at different times.

1) It measures what heirs keep after their taxes

Traditional (pre-tax) retirement accounts usually create taxable income when withdrawn. Roth accounts generally create tax-free withdrawals (assuming qualified rules are met). So from an heir’s perspective, $1 in a Roth is often worth more than $1 in a Traditional account—because less of it is lost to taxes.

That’s why this goal can recommend more Roth conversion than a “minimize lifetime taxes” objective would: it may be worth paying some taxes during your lifetime if it increases the after-tax inheritance.

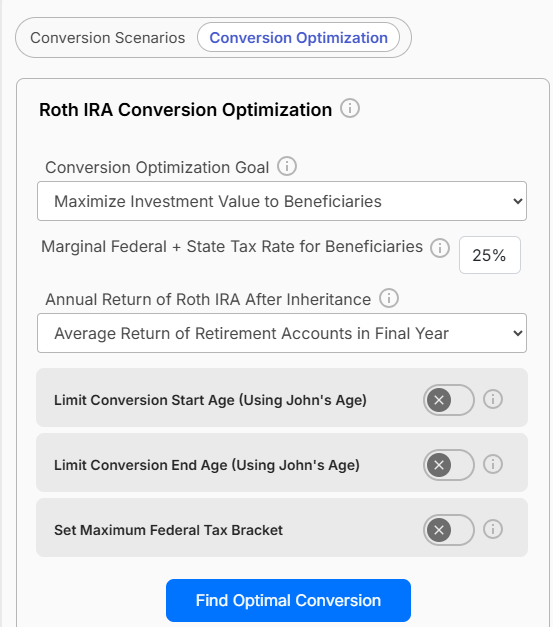

Entering the beneficiary tax rate

To model this, the tool lets you input an assumed beneficiary marginal tax rate (and sometimes state rate, depending on the setup). This is used as the estimated rate your beneficiary pays on taxable withdrawals they take from inherited pre-tax accounts.

- Higher beneficiary tax rate → Roth becomes more valuable → optimizer tends to favor more conversions

- Lower beneficiary tax rate → Traditional is less “penalized” → optimizer may recommend fewer conversions

Why marginal rate? Because inherited withdrawals generally “stack” on top of the beneficiary’s existing income. Using a marginal rate is a practical way to estimate the tax cost of each additional dollar they withdraw.

Tip: If you’re unsure, many people run it twice—once with a conservative (lower) rate and once with a higher rate—to see how sensitive the recommendation is.

2) It uses present value to compare strategies fairly

Beneficiary value often arrives years in the future, not today. A strategy that produces $500,000 more for heirs—but only 25 years later—shouldn’t be treated the same as $500,000 delivered sooner. That’s where present value comes in.

What present value means here

Present value is a way to translate a future amount into “today’s dollars” using a discount rate. Conceptually:

- Future dollars are “discounted” because of time, uncertainty, and opportunity cost.

- The optimizer uses this so it can compare conversion paths that change when beneficiaries receive value.

A simplified version looks like:

$$PV = \frac{FV}{(1+r)^n}$$

Where:

- $PV$ = present value (today’s dollars)

- $FV$ = future value delivered to beneficiaries

- $r$ = discount rate (the tool may use an assumed rate or one tied to your plan settings)

- $n$ = number of years until the beneficiary receives the value

What this changes in recommendations

Using present value means the optimizer tends to prefer strategies that:

- Create more reliable after-tax value, not just bigger numbers far out in the future

- Avoid pushing too much value into very late years if the discounted benefit becomes small

- Still converts when it’s efficient, but evaluates whether paying tax today is “worth it” based on what heirs keep in present-value terms

3) Putting it together: how the optimizer scores each conversion path

For every potential conversion strategy, the optimizer roughly asks:

- What balances will be left to beneficiaries? (Traditional vs Roth)

- What is the expected tax cost to beneficiaries?

- Traditional withdrawals are reduced by the beneficiary tax rate you enter

- Roth withdrawals are generally not reduced (qualified assumptions)

- When do beneficiaries receive the money?

- What is the present value of what they keep after taxes?

Then it picks the strategy with the highest present value of after-tax beneficiary outcomes, subject to your constraints (conversion ages, bracket cap, IRMAA sensitivity, etc.).

Practical guidance for the beneficiary tax rate input

Here are common ways people choose a rate:

- Single beneficiary who’s a high earner: use a higher marginal rate assumption

- Multiple beneficiaries with mixed incomes: use a blended/average assumption

- Unknown future situation: run a low/mid/high scenario (e.g., 12%, 22%, 32%) and compare results

This goal is especially impactful when:

- You expect beneficiaries to be in higher brackets than you

- You want to reduce the chance they inherit a large pre-tax balance that creates big taxable withdrawals

- Legacy value matters more than minimizing taxes during your lifetime