Monte Carlo Guardrails

How do I change my spending behavior in Monte Carlo simulations based on how my portfolio is doing?

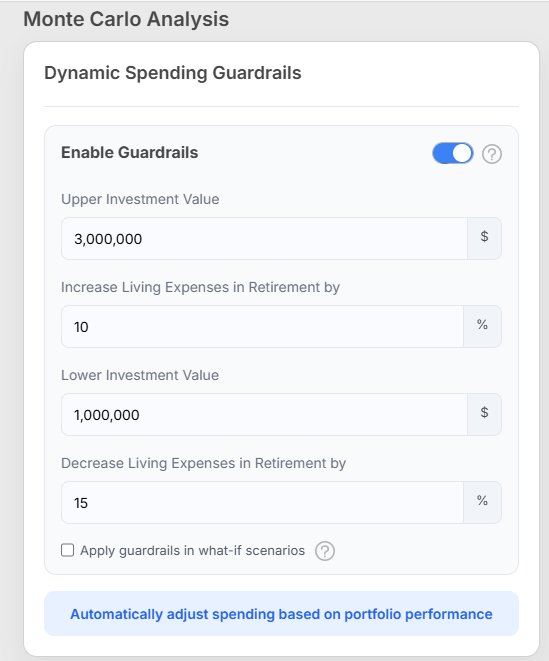

Dynamic Spending Guardrails

Dynamic Spending Guardrails let you model a simple, rules-based spending change inside the Monte Carlo simulation:

- If the portfolio value rises above an upper threshold, the simulation assumes you increase spending on living expenses in retirement by a set percentage.

- If the portfolio value falls below a lower threshold, the simulation assumes you decrease spending on living expenses in retirement by a set percentage.

- If the portfolio stays between the two thresholds, spending stays on the baseline path.

This helps your results reflect how many people actually behave: spending a bit more when things are going well and tightening up when markets go against them.

How it works in the simulation

For each Monte Carlo trial (each simulated “path”) in every year, the engine checks the portfolio value during retirement and applies the rule:

- Above “Upper Investment Value” → Increase Living Expenses in Retirement by X%

- Below “Lower Investment Value” → Decrease Living Expenses in Retirement by Y%

- Between thresholds → No change

The adjustment is applied to living expenses in retirement (not wages, not contributions), and only when guardrails are enabled.

Settings explained (from the screen)

- Enable Guardrails

Turns the behavior on/off. - Upper Investment Value ($)

The portfolio value that triggers an increase in spending. - Increase Living Expenses in Retirement by (%)

How much the simulation increases retirement living expenses when the portfolio is above the upper threshold. - Lower Investment Value ($)

The portfolio value that triggers a decrease in spending. - Decrease Living Expenses in Retirement by (%)

How much the simulation decreases retirement living expenses when the portfolio is below the lower threshold. - Apply guardrails in what-if scenarios

If checked, the same guardrail rules are also applied when you run what-if comparisons.

What this changes (and what it doesn’t)

- It does change the spending path inside each simulation based on portfolio performance relative to your thresholds.

- It does not try to “optimize” spending year-by-year or make complex decisions—this is a straightforward threshold rule you control.